In a crowded marketplace of forex and CFD brokers, how do you choose a platform that’s not only well-regulated but also ideal for long-term, consistent growth? If you’re not just looking for a trading account, but a platform that can support your systematic development, offer a wide range of products, and provide stable services—XM, a veteran broker founded in 2009 and trusted by over 5 million users globally, is certainly a contender worth your attention.

This article explores XM from five key dimensions: company background, business model, frequently asked questions, comparative analysis with prop trading platforms, and neutral ratings from BrokerHive, helping you make a professional, well-informed decision.

XM Background: Trusted Since 2009

Founded in 2009 under Trading Point Holdings Ltd., XM is a globally recognized multi-asset broker. As of today, it serves more than 5 million clients across 190+ countries.

Global Regulatory Coverage

XM holds multiple internationally recognized financial licenses, including:

- ASIC – Australian Securities and Investments Commission

- CySEC – Cyprus Securities and Exchange Commission

- DFSA – Dubai Financial Services Authority

- FSC – Financial Services Commission (Belize)

These diverse regulatory approvals provide robust protection for clients’ funds and ensure a fair, transparent trading environment.

Deep Dive: What Does XM Offer?

- Multiple Account Types for Different Stages

XM offers four account types, catering to traders at various stages:

- Micro Account: Ideal for beginners. 1 lot equals 1,000 units, allowing traders to learn with minimal risk.

- Standard Account: For more experienced users. 1 lot = 100,000 units (standard lot size).

- Ultra Low Account: Designed for cost-sensitive and frequent traders, featuring spreads as low as 0.6 pips.

- Shares Account: Provides direct access to real U.S. stock trading, targeted at professional investors.

Minimum deposit starts from just $5, making it highly accessible for new users. All accounts use floating spreads and zero commission, offering transparent and cost-efficient trading.

- Wide Range of Instruments

Traders on XM can access a broad range of markets, including:

- Major forex pairs (EUR/USD, GBP/JPY, etc.)

- Global stock indices (S&P 500, Nikkei 225, Hang Seng)

- Precious metals, commodities, and energy

- Stocks and ETFs (available in the Shares Account only)

This extensive offering supports a variety of trading strategies—from trend-following to volatility arbitrage.

- Seamless Multi-Device Compatibility

Whether on web, desktop, or mobile (iOS/Android), XM’s MT4/MT5 terminals have been optimized for smooth user experience. The mobile platform, in particular, is praised for its speed and reliability, ensuring traders never miss market opportunities. XM also supports advanced features like:

- One-click trading

- Expert Advisors (EAs)

- Multi-chart layouts

- Low-latency order execution

FAQ: What New Traders Want to Know

- Does XM allow automated/EA trading?

Yes. XM permits EAs and automated strategies on MT4/MT5. However, high-frequency or arbitrage-style trading may be restricted. - How easy is it to withdraw funds from XM?

Very. XM supports bank transfers, credit cards, Skrill, Neteller, and more. Withdrawals are typically fast and fee-transparent. - Is there support in Chinese?

Yes. XM offers a fully localized website, Chinese-speaking support staff, and education resources tailored to new traders. - Is there an account growth mechanism like scaling capital?

Not directly. XM doesn’t offer capital scaling like prop firms, but it provides bonuses, promotions, and loyalty programs as indirect support. - Are demo accounts available?

Absolutely. XM provides free demo accounts with real market conditions, perfect for strategy testing and platform familiarization.

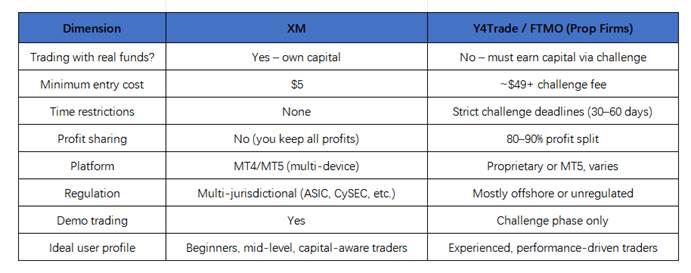

XM vs. Prop Trading Platforms: A Head-to-Head Comparison

XM is a classic real-money broker. You trade with your own funds, keep all profits, and face no deadlines. It’s ideal for traders who want to build a disciplined, long-term strategy and retain full control over capital.

Prop firms like Y4Trade or FTMO allow traders to trade with the firm’s money, but only after passing rigorous challenges with strict rules. While these platforms offer high returns on success, they also come with greater pressure, time limits, and risk of disqualification.

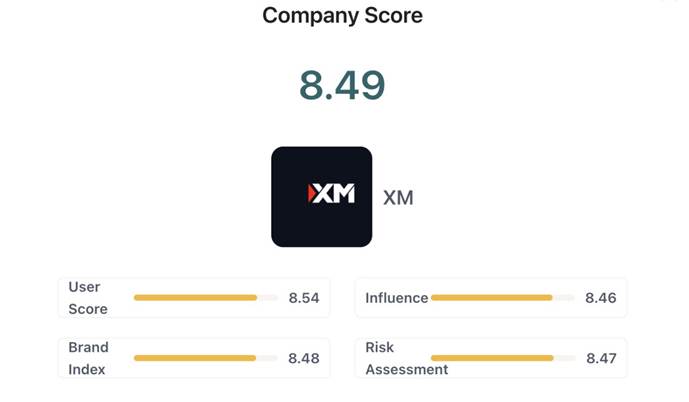

BrokerHive Rating: 8.9 / 10 — A Solid Choice for Stability-First Traders

According to the BrokerHive platform rating system, XM currently holds a comprehensive score of 8.9 out of 10. As a well-established broker with over a decade of operational history and multiple international financial licenses, XM performs exceptionally well in terms of platform stability, regulatory compliance, product diversity, and trading transparency.

Overall, XM has built a solid brand presence in global markets, backed by a large user base and strong industry reputation. Its trading infrastructure is stable, it supports a wide range of deposit and withdrawal methods, and it offers full Chinese-language support—making it a representative example of a “veteran, stability-focused” brokerage.

From BrokerHive’s neutral perspective, XM is best suited for traders who aim to build a long-term trading system and develop sound capital management practices. It is especially ideal for users seeking consistent profitability, disciplined strategies, and high standards in platform transparency and regulatory assurance.

That said, XM still relies on the standard MT4 and MT5 trading terminals. While these platforms are mature and widely used, they may appear somewhat conservative when compared to newer platforms that offer more extensibility and innovation.

It is important to note that, even with a stable platform and strong regulatory framework, trading in high-leverage markets such as forex and CFDs always carries risk. Without strict discipline and proper risk control, traders may still incur significant losses—even on a high-quality platform. Therefore, any broker should be viewed not as a guarantee of profit, but as a tool for developing a sustainable trading strategy.

If you are a beginner or intermediate trader looking for a secure, regulated, and stable environment to build your trading journey, XM is a strong option to consider. Its diverse account types, transparent fee structure, and extensive educational resources provide a solid foundation for live trading.

However, if you prefer to scale your trading through funded challenges, it may also be worthwhile to use XM in conjunction with platforms that offer capital challenge programs.

Final Thoughts: XM Is Built for Steady, Strategic Growth

With global regulators tightening restrictions on high-leverage crypto and derivatives products in 2024–2025, more traders are shifting toward well-regulated, transparent brokers. XM has not only retained its client base through this transition but also expanded it—proving that compliance and safety are back in vogue.

If you want to build a systematic, capital-controlled, long-term trading career, XM is a serious contender worth your attention.

At BrokerHive, our mission is to deliver unbiased, verified broker data—from licensing details to user reviews and trading models—to help you make smarter, safer trading choices.

Visit BrokerHive to explore more platform ratings and comparisons, and take the first step toward informed, professional trading.