In today’s fast-paced financial world, staying ahead of the curve is essential. Fintechzoom.com Bonds is a groundbreaking platform redefining how investors view and engage with stocks. Gone are the days of overwhelming charts and confusing jargon, this platform makes investing simple, intuitive, and even enjoyable.

Whether you’re an experienced trader or just starting out, Fintechzoom.com Bonds empowers you with real-time insights and data-driven tools. Let’s explore how this platform is reshaping investment strategies and turning cutting-edge technology into opportunity for every type of investor.

Fintechzoom.com Bonds: What Is It and How Does It Work?

The financial landscape is evolving rapidly, and Fintechzoom.com Bonds is at the forefront of that transformation. This innovative platform simplifies how investors analyze stocks and bonds, providing advanced analytics in a user-friendly environment.

Instead of relying on complex reports or outdated tools, Fintechzoom.com Bonds offers an accessible, tech-driven solution for both beginners and professionals. As fintech adoption accelerates worldwide, this platform stands out by merging technology with transparent market insights making smarter investing easier than ever before.

Also Read: Fintechzoom.io Stock Market Course: The Ultimate Guide to Modern Trading Education

The Rise of Fintech in the Stock Market

Technology is revolutionizing how people invest, and Fintechzoom.com Bonds plays a crucial role in this shift. Fintech platforms are breaking down barriers, allowing anyone to trade, research, and analyze markets directly from their devices.

Advanced algorithms now process market data in seconds, giving retail investors access to insights that were once exclusive to professionals. This evolution has democratized investing—empowering individuals to take control of their portfolios with confidence and speed.

Understanding the Basics of Bonds: What are they and how do they differ from stocks?

Before exploring Fintechzoom.com Bonds, it’s important to understand what bonds are. A bond represents a loan made by an investor to a company or government, paying interest over time until maturity.

Unlike stocks—which give ownership—bonds create a creditor relationship. Stocks can yield high returns but carry higher risk, while bonds provide stability and predictable income. Fintechzoom.com Bonds helps investors balance these two assets, crafting portfolios that fit unique goals and risk profiles.

Why Choose Fintechzoom.com Bonds for Stock Market Analysis?

Investors are always on the lookout for tools that simplify stock market analysis. Fintechzoom.com bonds stand out as an innovative choice in this dynamic landscape.

One of its key advantages is the seamless integration of advanced analytics. Users can access a wealth of data at their fingertips, enabling informed decision-making.

Additionally, the platform offers tailored insights based on individual investment goals. This customization makes it easier to align strategies with specific financial objectives.

The community aspect also enhances user experience. Engaging with fellow investors creates opportunities for shared learning and growth.

Moreover, real-time updates keep users ahead of market trends. Staying informed allows for quick adjustments in strategy when necessary.

Fintechzoom.com bonds provide a comprehensive approach to stock market analysis, making it an attractive option for both novice and seasoned investors alike.

Suggested Read: Fintechzoom.io: The Ultimate Platform for Stock Market and Crypto Trading

How Fintechzoom.com Bonds Transforms Stock Market Investing

Fintechzoom.com Bonds transforms the stock market landscape with its innovative features. Users gain access to real-time insights that empower informed investment decisions. Market fluctuations are analyzed swiftly, allowing investors to adapt strategies quickly.

Customization takes center stage. Investors can tailor their portfolios based on individual risk tolerance and goals, making every investment personal and strategic. This flexibility is a game-changer for both novice and seasoned traders.

The platform’s user-friendly interface simplifies complex processes. Navigating through data-rich resources feels intuitive, enhancing the overall experience for users at any skill level.

Community engagement further enriches the investing journey. By sharing experiences and strategies, users cultivate a collaborative environment that encourages learning and growth in stock market knowledge.

Fintechzoom.com Bonds doesn’t just offer tools; it builds an ecosystem where investors thrive together in dynamic markets.

Real-time Market Insights and Analysis

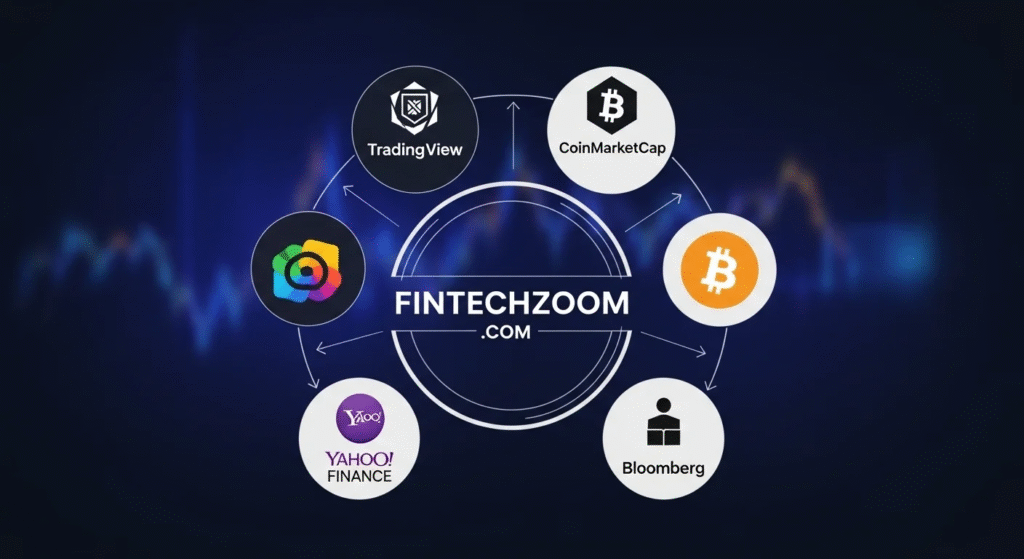

Real-time market insights are vital for any investor looking to make informed decisions. With Fintechzoom.com bonds, users gain access to a wealth of up-to-the-minute data that shapes investment strategies.

The platform aggregates information from various financial news sources and market movements. This allows investors to stay ahead of trends, spotting opportunities before they become widely recognized.

A unique feature is the ability to track specific sectors or stocks in real time. Investors can receive alerts on significant price changes or breaking news related to their interests.

This immediacy empowers users with knowledge at their fingertips, helping them navigate the complexities of stock market fluctuations effectively. It’s not just about numbers; it’s about context and understanding how events impact investments instantly.

Customizable Investment Options

One of the standout features of fintechzoom.com bonds is the customizable investment options it offers. Investors can tailor their portfolios to match their financial goals and risk tolerance.

You have the flexibility to choose from a diverse range of bond types, durations, and yield expectations. This allows you to create a strategy that aligns perfectly with your vision for growth or income generation.

Furthermore, users can adjust their investments as market conditions change. Want to pivot toward safer government bonds during turbulent times? No problem. Prefer high-yield corporate bonds when markets are on an upswing? Easily done.

The platform also provides tools that help visualize potential outcomes based on different scenarios. This empowers investors not just to make choices but informed decisions tailored specifically to their individual needs and preferences.

User-Friendly Interface and Accessibility

Navigating financial markets can be daunting. With countless platforms flooding the scene, a user-friendly interface becomes essential. Fintechzoom.com Bonds stands out in this regard.

The design is clean and intuitive. New users find it easy to get started without feeling overwhelmed by complexity. Every feature is just a click away.

Interactive charts and tools simplify data comprehension. Investors can track trends effortlessly, making informed decisions faster than ever before.

Mobile responsiveness adds another layer of convenience. Whether on a desktop or smartphone, the experience remains seamless across devices.

Help resources are readily accessible too. Tutorials guide users through various functionalities, ensuring everyone maximizes their investment potential with minimal frustration.

Success Stories: Case Studies of Users Who Have Benefited from Fintechzoom.com Bonds

Many users have turned to fintechzoom.com bonds and seen transformative results. Take Sarah, for example. With a limited background in investing, she discovered the platform’s unique bond features. Within months, her understanding of market trends improved significantly.

Then there’s Mike, who was skeptical at first. After engaging with real-time insights offered by fintechzoom.com bonds, he gained confidence in making informed decisions. His portfolio grew steadily as he tailored his investments based on personalized analytics.

Tom found success through the user-friendly interface that simplified complex data into actionable strategies. He leveraged customizable options to diversify his holdings effectively.

These individual stories highlight how diverse investors can thrive using fintechzoom.com bonds while navigating the stock market landscape with ease and assurance. Each experience is a testament to the platform’s potential impact on investment journeys across different skill levels.

Alternatives to Fintechzoom.com Bonds

When exploring alternatives to Fintechzoom.com Bonds, several platforms stand out in the crowded landscape of stock market analysis and investment tools. Each offers unique features that cater to different types of investors.

One notable alternative is Robinhood, which has gained popularity for its commission-free trading model. It provides an intuitive mobile app that appeals to beginner investors looking for a simple way to buy and sell stocks without incurring fees.

Another option is E*TRADE, known for its robust research resources and advanced trading tools. This platform caters more toward seasoned traders who require comprehensive data analytics before making investment decisions.

For those interested in social trading, eToro allows users to follow and copy successful traders’ strategies automatically. This feature makes it easier for novices to enter the market by leveraging experienced investors’ insights.

Lastly, Wealthfront focuses on automated investing through robo-advisors. By using algorithms tailored to individual risk tolerances, it helps manage portfolios efficiently without requiring constant user input or extensive financial knowledge.

Each of these platforms has strengths that may suit various investor needs better than fintechzoom.com bonds might. Choosing the right one depends on personal preferences regarding features like ease of use, research capabilities, or specific investment strategies you wish to pursue as you navigate the ever-evolving world of finance.

Also Read: FintechZoom.com Nikkei 225: History, Key Insights, and Market Impact Explained

Final Thoughts

Fintechzoom.com Bonds is changing how people understand and invest in both bonds and stocks. By merging technology with education and real-time data, it gives investors of all levels the power to make smarter, faster, and more confident decisions.

As the financial world continues to evolve, platforms like Fintechzoom.com Bonds are leading the revolution—simplifying investing while maximizing potential returns.

FAQ’s

Answer: Fintechzoom.com Bonds are investment tools and insights offered by FintechZoom, providing analysis, news, and strategies for bond investors.

Answer: You can explore bond data, track trends, and use the platform’s analytics to make informed investment decisions through your brokerage account.

Answer: Yes, the platform provides user-friendly insights, educational resources, and analysis that help beginners understand bond markets before investing.

Answer: Fintechzoom.com covers government bonds, corporate bonds, municipal bonds, and other fixed-income investment options.

Answer: Yes, it offers up-to-date market insights, trends, and analytics to help investors make timely and informed decisions.